Wayne County Nc Property Appraiser

Next County 2025-26 2024-25 2023-24 2022-23 2021-22 ...

2026. Ashe .4400 .4400 .4400 .5100 .5100. 2023. 2027. Avery .4000 .4000 .4000 ... NORTH CAROLINA COUNTY PROPERTY TAX RATES. FOR THE LAST FIVE YEARS. (All ...

https://www.ncdor.gov/2025-2026-county-tax-rates-finalpdf/openWayne County, NC | Official Website

This website is AudioEye enabled and is being optimized for accessibility. To open the AudioEye Toolbar, press "shift + =". Some assistive technologies may require the use of a passthrough function before this keystroke. For more information, activate the button labeled “Explore your accessibility options”.

https://www.waynegov.com/Wayne County, NC | Official Website

This website is AudioEye enabled and is being optimized for accessibility. To open the AudioEye Toolbar, press "shift + =". Some assistive technologies may require the use of a passthrough function before this keystroke. For more information, activate the button labeled “Explore your accessibility options”.

https://www.waynegov.com/County Property Tax Rates and Reappraisal Schedules | NCDOR

The Raleigh Service Center has moved to its new location on Highwoods Blvd following regular business hours. Review the Raleigh Service Center's new address and business hours. A new tax on alternative nicotine products will also be imposed. Tax related to the rate change of product in inventory as of July 1 will apply.

https://www.ncdor.gov/taxes-forms/property-tax/property-tax-rates/county-property-tax-rates-and-reappraisal-schedules

County Property Tax Rates and Reappraisal Schedules | NCDOR

The Raleigh Service Center has moved to its new location on Highwoods Blvd following regular business hours. Review the Raleigh Service Center's new address and business hours. A new tax on alternative nicotine products will also be imposed. Tax related to the rate change of product in inventory as of July 1 will apply.

https://www.ncdor.gov/taxes-forms/property-tax/property-tax-rates/county-property-tax-rates-and-reappraisal-schedules

2026 North Carolina Development Tier Designations

The county unemployment rate rank improved 27 positions and its adjusted property tax base per capita rank improved by 26 positions. Stanly County. For 2026, ...

https://www.commerce.nc.gov/report-county-tiers-ranking-memo-current-year/openWayne County, NC Property Tax Calculator 2025-2026

Calculate Your Wayne County Property Taxes Wayne County Tax Information How are Property Taxes Calculated in Wayne County? Property taxes in Wayne County, North Carolina are calculated based on your property's assessed value multiplied by the local tax rate. The county's effective tax rate of 0.76% is applied to determine your annual property tax obligation.

https://propertytaxescalculator.com/northcarolina/wayne-county

Wayne County, NC Property Tax Calculator 2025-2026

Calculate Your Wayne County Property Taxes Wayne County Tax Information How are Property Taxes Calculated in Wayne County? Property taxes in Wayne County, North Carolina are calculated based on your property's assessed value multiplied by the local tax rate. The county's effective tax rate of 0.76% is applied to determine your annual property tax obligation.

https://propertytaxescalculator.com/northcarolina/wayne-county

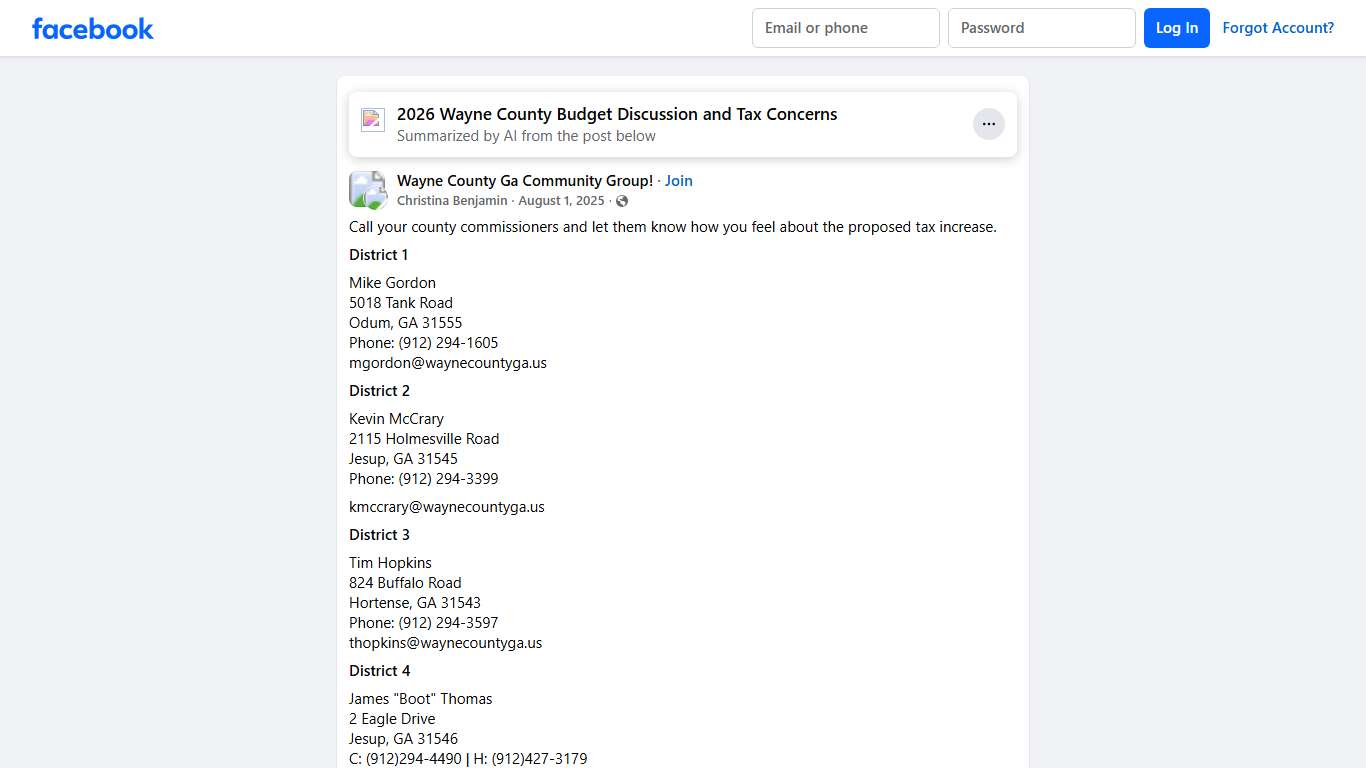

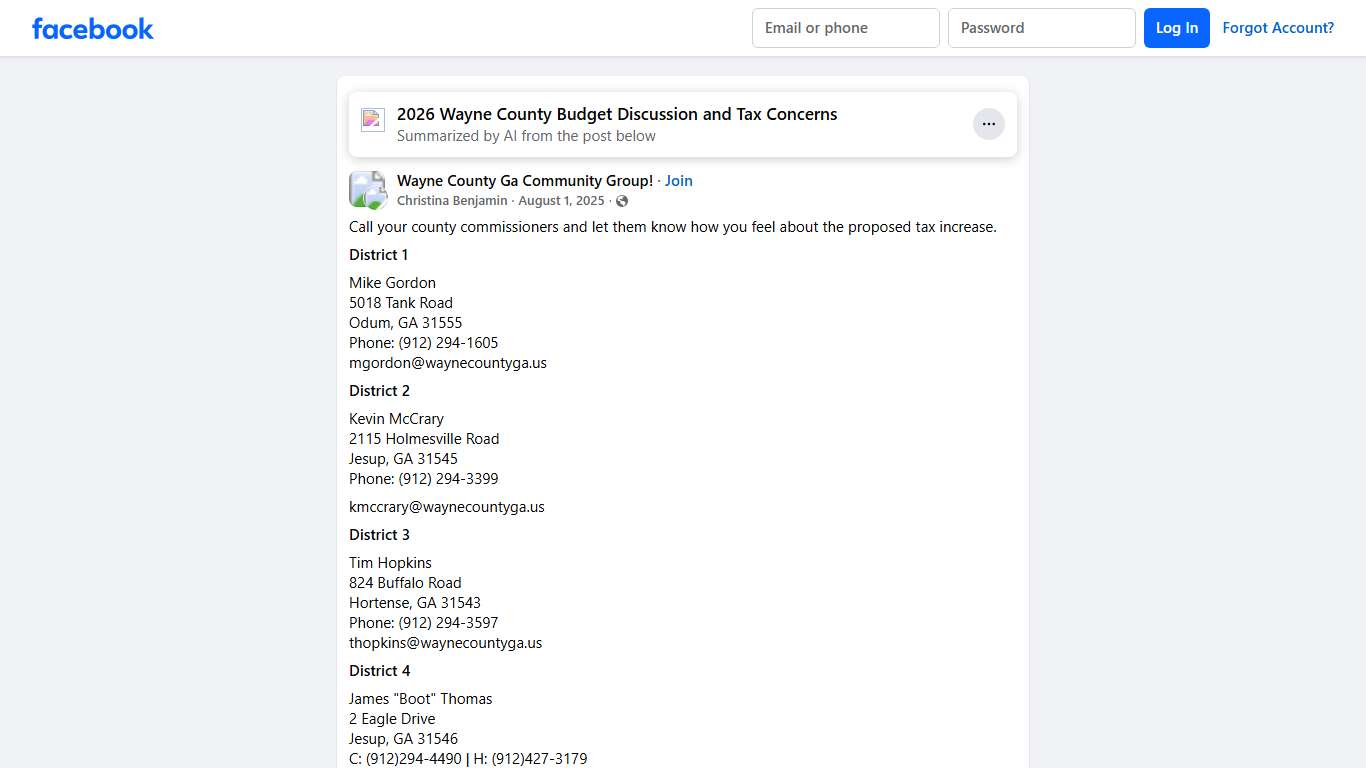

Wayne County Ga Community Group! | Call your county commissioners and let them know how you feel about the proposed tax increase | Facebook

According to the Press – Sentinel, The County Commission says it must raise the millage rate this year. According to the same article the county currently has a 25% reserve. I agree with this practice of keeping a reserve. However, due to long standing disparities in equity between property values county-wide , they have ordered a county wide re-evaluation.

https://www.facebook.com/groups/644406124170084/posts/1141461244464567/

Wayne County Ga Community Group! | Call your county commissioners and let them know how you feel about the proposed tax increase | Facebook

According to the Press – Sentinel, The County Commission says it must raise the millage rate this year. According to the same article the county currently has a 25% reserve. I agree with this practice of keeping a reserve. However, due to long standing disparities in equity between property values county-wide , they have ordered a county wide re-evaluation.

https://www.facebook.com/groups/644406124170084/posts/1141461244464567/

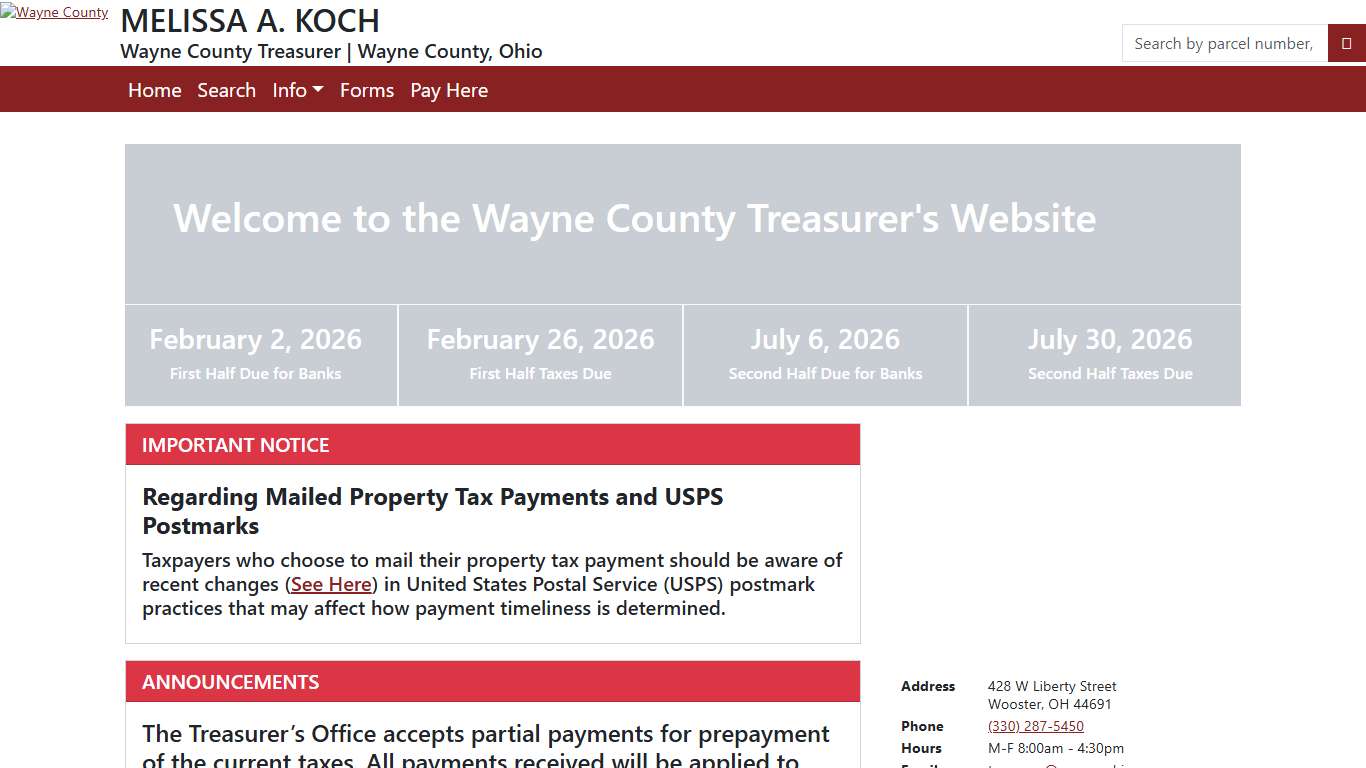

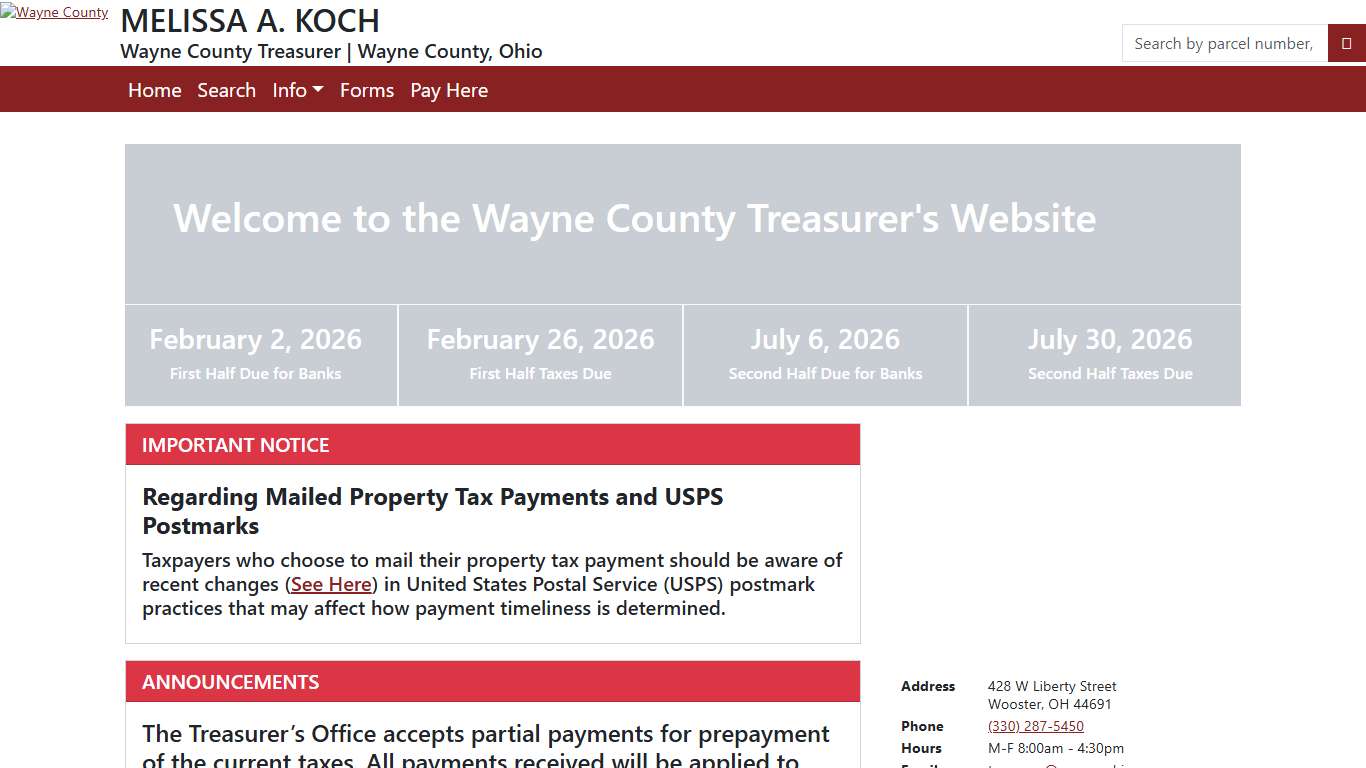

Wayne County Treasurer Website

Regarding Mailed Property Tax Payments and USPS Postmarks Taxpayers who choose to mail their property tax payment should be aware of recent changes (See Here) in United States Postal Service (USPS) postmark practices that may affect how payment timeliness is determined.

https://waynecountytreasurer.org/

Wayne County Treasurer Website

Regarding Mailed Property Tax Payments and USPS Postmarks Taxpayers who choose to mail their property tax payment should be aware of recent changes (See Here) in United States Postal Service (USPS) postmark practices that may affect how payment timeliness is determined.

https://waynecountytreasurer.org/

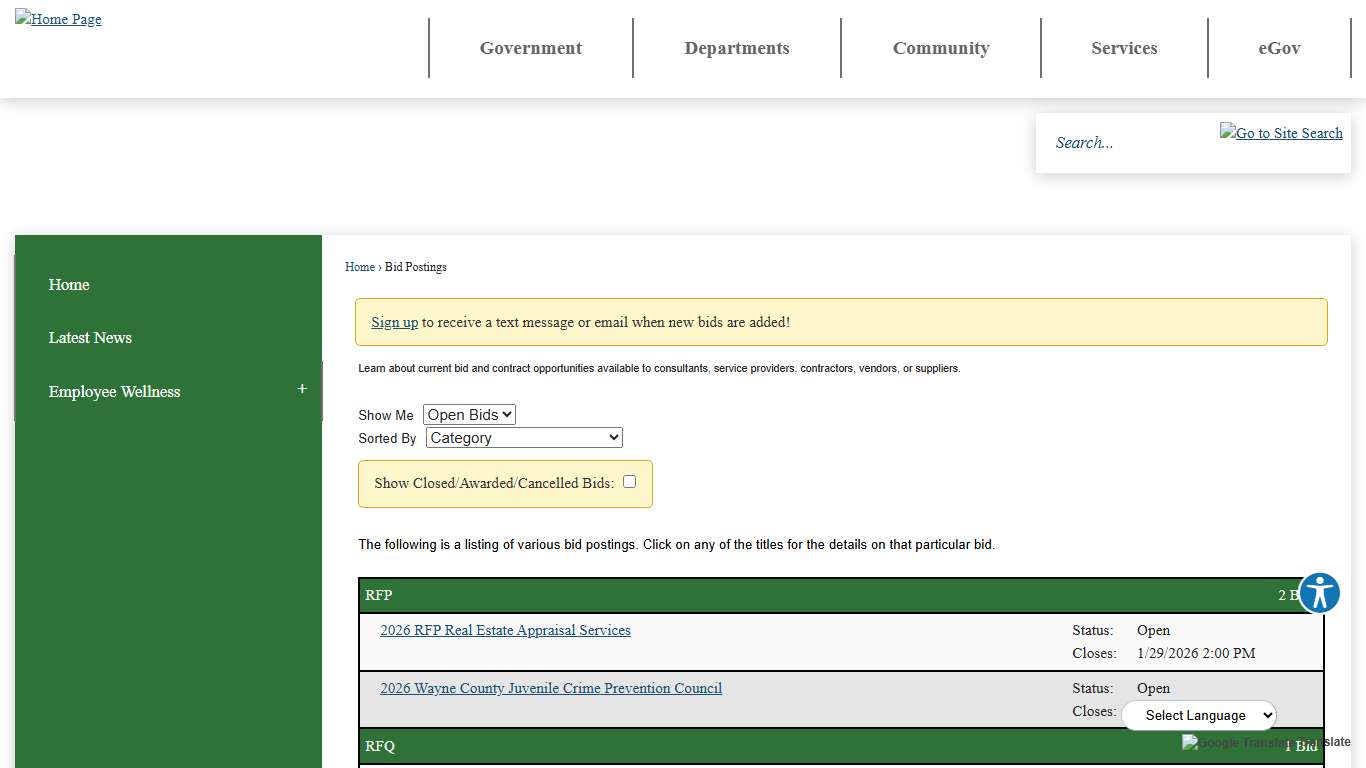

Bid Postings • Wayne County, NC • CivicEngage

This website is AudioEye enabled and is being optimized for accessibility. To open the AudioEye Toolbar, press "shift + =". Some assistive technologies may require the use of a passthrough function before this keystroke. For more information, activate the button labeled “Explore your accessibility options”.

https://www.waynegov.com/Bids.aspx

Bid Postings • Wayne County, NC • CivicEngage

This website is AudioEye enabled and is being optimized for accessibility. To open the AudioEye Toolbar, press "shift + =". Some assistive technologies may require the use of a passthrough function before this keystroke. For more information, activate the button labeled “Explore your accessibility options”.

https://www.waynegov.com/Bids.aspx

Wayne County Property Taxes: Are They Going Up, and What Are They Used For? - Wayne County News

The probability of a property tax increase has been on Wayne County property owners’ minds lately, especially after the Wayne County Budget Committee recommended a ten-cent increase to the County Commission for their approval. Although each member of the Budget Committee expressed their reluctance to vote yes on an increase, they were all in agreement that a property tax increase must take place to fund the county’s FY 2025-2026 budget.

https://waynecountynews.net/stories/wayne-county-property-taxes-are-they-going-up-and-what-are-they-used-for,90601

Wayne County Property Taxes: Are They Going Up, and What Are They Used For? - Wayne County News

The probability of a property tax increase has been on Wayne County property owners’ minds lately, especially after the Wayne County Budget Committee recommended a ten-cent increase to the County Commission for their approval. Although each member of the Budget Committee expressed their reluctance to vote yes on an increase, they were all in agreement that a property tax increase must take place to fund the county’s FY 2025-2026 budget.

https://waynecountynews.net/stories/wayne-county-property-taxes-are-they-going-up-and-what-are-they-used-for,90601

Wayne County... - Wayne County Government, North Carolina | Facebook

Wayne County voters will see a local option sales tax referendum on the March 3, 2026 Primary Election ballot. If approved by voters, the tax is estimated to generate approximately $3.41 million per year for Wayne County. The Wayne County Board of Commissioners approved a resolution pledging the use of funds to Support School Resource Officers (SROs) and fund school capital and facility needs.

https://www.facebook.com/waynecountygov/posts/wayne-county-voters-will-see-a-local-option-sales-tax-referendum-on-the-march-3-/1298399928993137/

Wayne County... - Wayne County Government, North Carolina | Facebook

Wayne County voters will see a local option sales tax referendum on the March 3, 2026 Primary Election ballot. If approved by voters, the tax is estimated to generate approximately $3.41 million per year for Wayne County. The Wayne County Board of Commissioners approved a resolution pledging the use of funds to Support School Resource Officers (SROs) and fund school capital and facility needs.

https://www.facebook.com/waynecountygov/posts/wayne-county-voters-will-see-a-local-option-sales-tax-referendum-on-the-march-3-/1298399928993137/

North Carolina Property Tax Calculator - SmartAsset

Overview of North Carolina Taxes North Carolina’s property tax rates are relatively low in comparison to those of other states. The effective property tax rate in North Carolina is 0.73%, well under the national average of 0.90%. - About This Answer To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address.

https://smartasset.com/taxes/north-carolina-property-tax-calculator

North Carolina Property Tax Calculator - SmartAsset

Overview of North Carolina Taxes North Carolina’s property tax rates are relatively low in comparison to those of other states. The effective property tax rate in North Carolina is 0.73%, well under the national average of 0.90%. - About This Answer To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address.

https://smartasset.com/taxes/north-carolina-property-tax-calculator

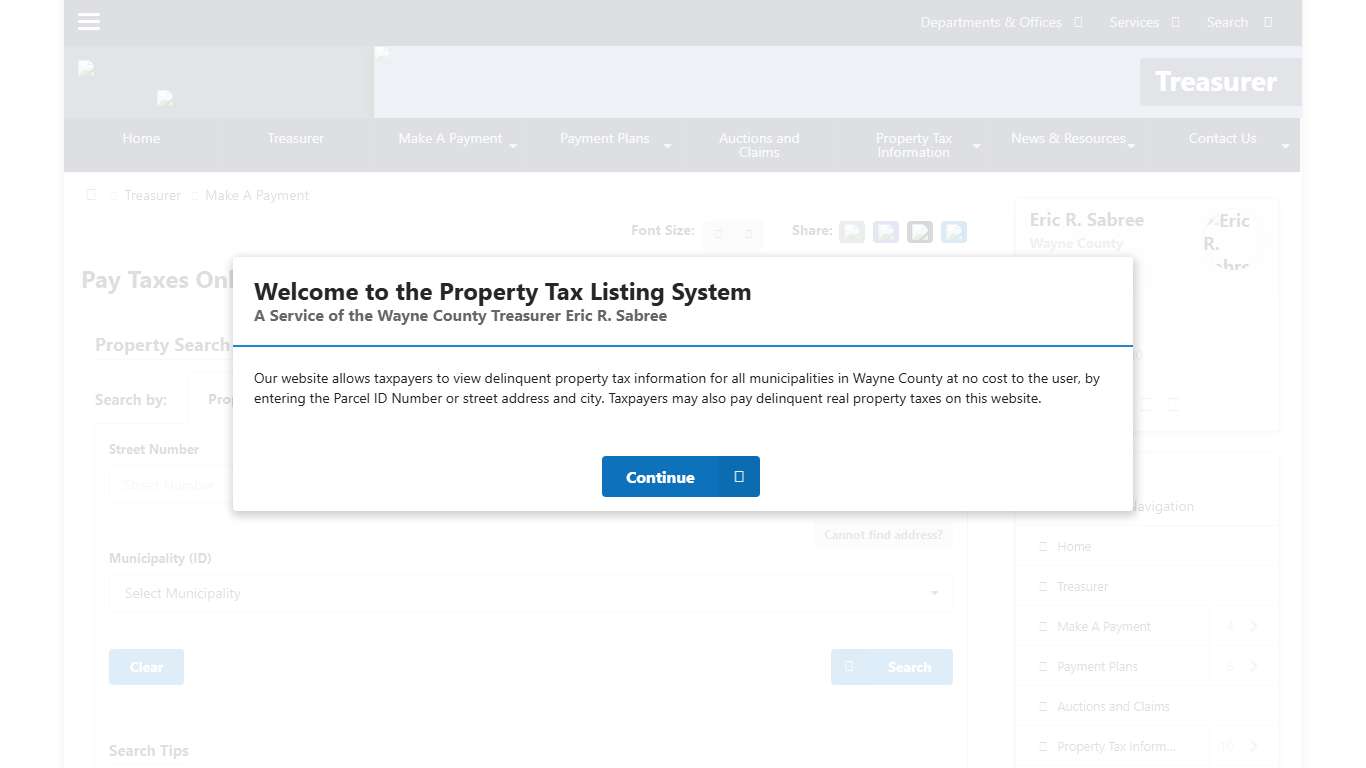

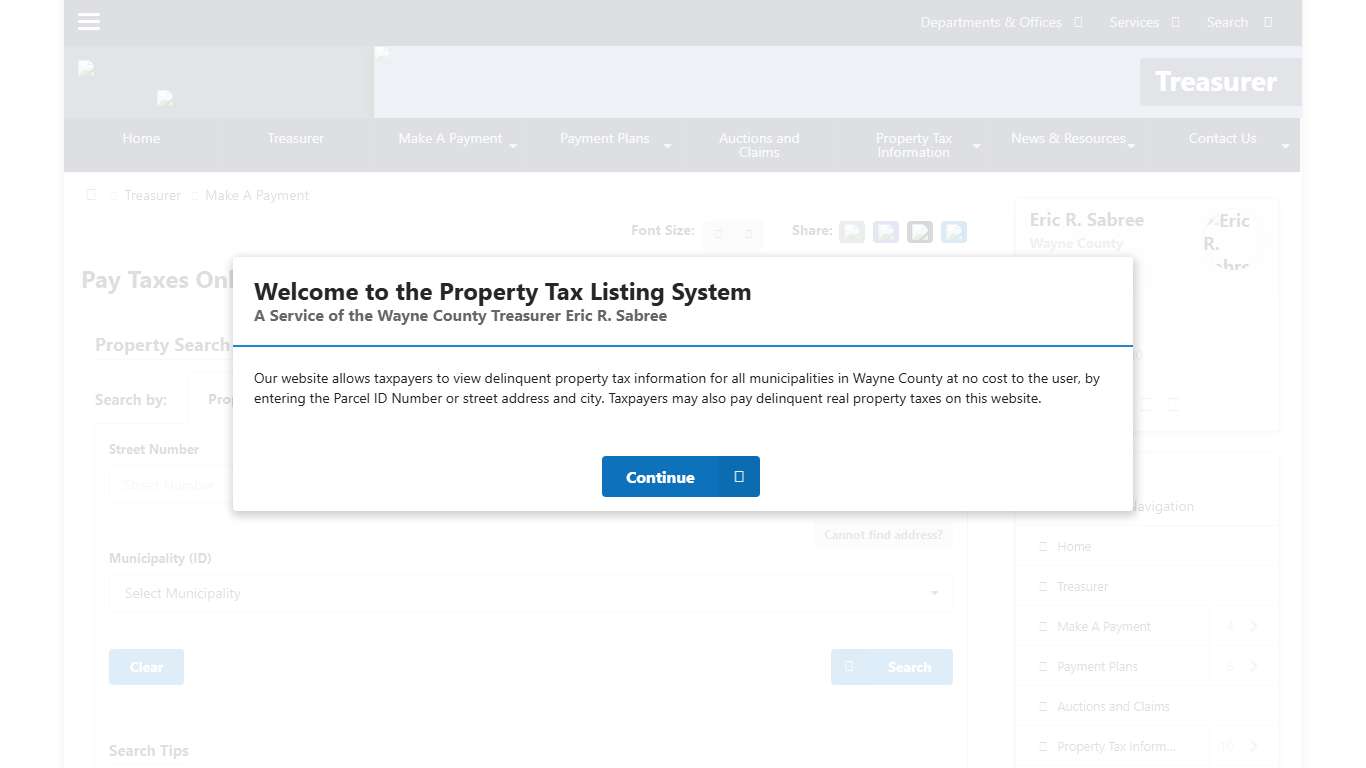

Pay Taxes Online | Treasurer

Share: Font Size: Pay Taxes Online Property Search Cannot find address ? Enter the name of the street without the ending ‘Street’ or ‘Avenue’. Enter the first three letters of the street name and all the streets starting with those letters will be searched.

https://pta.waynecounty.com/

Pay Taxes Online | Treasurer

Share: Font Size: Pay Taxes Online Property Search Cannot find address ? Enter the name of the street without the ending ‘Street’ or ‘Avenue’. Enter the first three letters of the street name and all the streets starting with those letters will be searched.

https://pta.waynecounty.com/

Wayne County, North Carolina Property Taxes - Ownwell

Wayne County, North Carolina Property Taxes Median Wayne County effective property tax rate: 0.85%, significantly lower than the national median of 1.02%. Median Wayne County home value: $66,340 Median annual Wayne County tax bill: $703, $1,697 lower than the national median property tax bill of $2,400.

https://www.ownwell.com/trends/north-carolina/wayne-county

Wayne County, North Carolina Property Taxes - Ownwell

Wayne County, North Carolina Property Taxes Median Wayne County effective property tax rate: 0.85%, significantly lower than the national median of 1.02%. Median Wayne County home value: $66,340 Median annual Wayne County tax bill: $703, $1,697 lower than the national median property tax bill of $2,400.

https://www.ownwell.com/trends/north-carolina/wayne-county

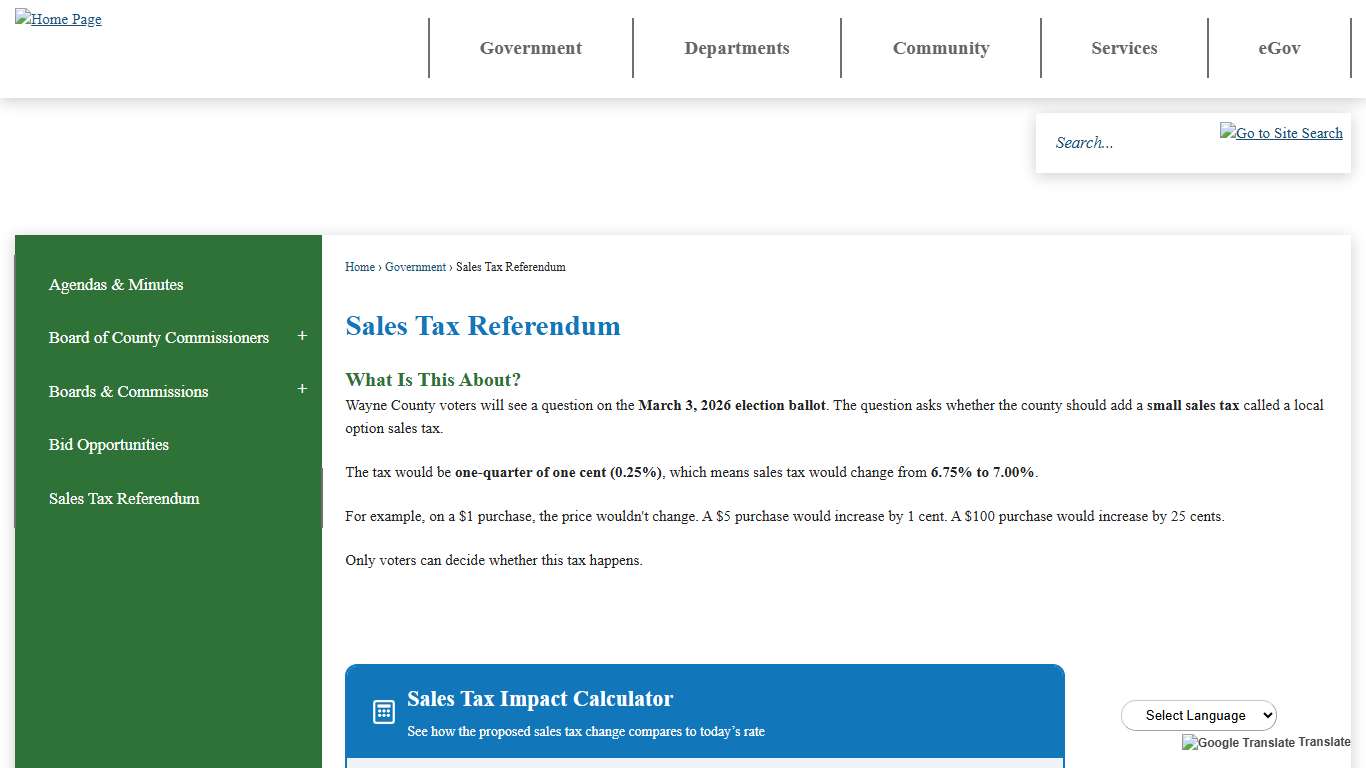

Sales Tax Referendum | Wayne County, NC

Wayne County voters will see a question on the March 3, 2026 election ballot. The question asks whether the county should add a small sales tax called a local option sales tax. The tax would be one-quarter of one cent (0.25%), which means sales tax would change from 6.75% to 7.00%.

https://www.waynegov.com/1147/Sales-Tax-Referendum

Sales Tax Referendum | Wayne County, NC

Wayne County voters will see a question on the March 3, 2026 election ballot. The question asks whether the county should add a small sales tax called a local option sales tax. The tax would be one-quarter of one cent (0.25%), which means sales tax would change from 6.75% to 7.00%.

https://www.waynegov.com/1147/Sales-Tax-Referendum

🎥 Important 2026 Property Tax Information for Haywood County Residents - As we head into the new year, Haywood County wants to make sure you’re aware of important 2026 property tax programs and requirements that may apply to you. 👵 Elderly or Disabled Property Tax Exclusion If you turn 65 or become totally and permanently disabled in 2025, and your total income is $38,800 or less, you may qualify for...

https://www.instagram.com/reel/DSnD0jKAkXV/

🎥 Important 2026 Property Tax Information for Haywood County Residents - As we head into the new year, Haywood County wants to make sure you’re aware of important 2026 property tax programs and requirements that may apply to you. 👵 Elderly or Disabled Property Tax Exclusion If you turn 65 or become totally and permanently disabled in 2025, and your total income is $38,800 or less, you may qualify for...

https://www.instagram.com/reel/DSnD0jKAkXV/

The Board of Commissioners officially adopted the FY2026 budget and it includes a 30 cent property tax rate reduction. Hear directly from Board of Commissioners Chairman Kirk deViere as he breaks down the Fiscal Year 2026 budget, what it means for our residents, and the key investments made in public safety, education, and community services. | Cumberland County, NC Government | Facebook

The Board of Commissioners officially adopted the FY2026 budget and it includes a 30 cent property tax rate reduction. Hear directly from Board of...

https://www.facebook.com/CCNCGov/videos/fiscal-year-2026-your-budget-a-message-from-chairman-kirk-deviere/1895693717916575/

The Board of Commissioners officially adopted the FY2026 budget and it includes a 30 cent property tax rate reduction. Hear directly from Board of Commissioners Chairman Kirk deViere as he breaks down the Fiscal Year 2026 budget, what it means for our residents, and the key investments made in public safety, education, and community services. | Cumberland County, NC Government | Facebook

The Board of Commissioners officially adopted the FY2026 budget and it includes a 30 cent property tax rate reduction. Hear directly from Board of...

https://www.facebook.com/CCNCGov/videos/fiscal-year-2026-your-budget-a-message-from-chairman-kirk-deviere/1895693717916575/

2026 Wayne County County Sales Tax Rate - Avalara

Wayne County sales tax details The minimum combined 2026 sales tax rate for Wayne County, North Carolina is 6.75%. This is the total of state, county, and city sales tax rates. The North Carolina sales tax rate is currently 4.75%. The Wayne County sales tax rate is 2.0%.

https://www.avalara.com/taxrates/en/state-rates/north-carolina/counties/wayne-county.html

2026 Wayne County County Sales Tax Rate - Avalara

Wayne County sales tax details The minimum combined 2026 sales tax rate for Wayne County, North Carolina is 6.75%. This is the total of state, county, and city sales tax rates. The North Carolina sales tax rate is currently 4.75%. The Wayne County sales tax rate is 2.0%.

https://www.avalara.com/taxrates/en/state-rates/north-carolina/counties/wayne-county.html